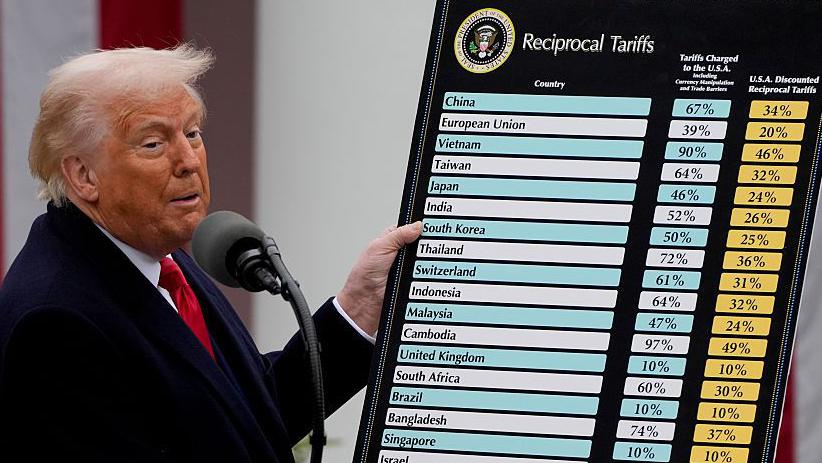

U.S. President Donald Trump has directed his White House administration to prepare for a 155% tariff on Chinese goods if a new trade deal is not finalized by November 1, 2025.

The directive, first reported by Business Standard and Economic Times, marks the most aggressive step in Trump’s trade policy since his return to office. White House officials confirmed that the President wants the plan ready as a “contingency option” should Beijing fail to agree on revised trade terms.

This bold warning has rattled global markets, triggering declines in stocks and cryptocurrencies, while boosting demand for safe-haven assets like gold and the U.S. dollar.

Trump Pushes for a New Deal Before November 1 Deadline

According to administration sources, President Trump believes that China has failed to meet previous trade obligations, particularly in technology and agricultural imports. He told reporters that unless “a fair and reciprocal deal” is signed by November 1, his government will impose a 155% tariff on all major Chinese imports, including electronics, steel, and consumer goods.

The White House statement emphasized that Trump’s goal is to “protect American workers and manufacturing industries” that continue facing competition from low-cost Chinese production. Markets interpreted the announcement as a signal of potential escalation in the long-standing U.S.–China trade tensions.

China’s Response: Warning Against Confrontation

Beijing’s initial reaction was cautious. The Chinese Ministry of Commerce said it supports “dialogue over confrontation” but will “defend national interests if necessary.” State media described Trump’s proposal as “economic coercion,” but analysts in Shanghai and Beijing agree that China wants to avoid confrontation before the G20 Leaders Summit scheduled for mid-November.

Following the White House statement, the Chinese yuan fell 0.4%, while the Shanghai Composite Index closed 1.2% lower. Regional markets, including Japan’s Nikkei 225 and South Korea’s KOSPI, also declined as traders feared a renewed trade war.

Global Markets React: Stocks Drop, Gold Climbs

The U.S. stock market opened sharply lower on the news. The S&P 500 fell 1.1%, the Nasdaq 100 dropped 1.4%, and the Dow Jones Industrial Average lost 0.9% by the afternoon session. Meanwhile, gold prices rose to $2,420 per ounce, reflecting a flight to safety. The U.S. Dollar Index gained 0.5%, reaching its highest level in two months.

European markets mirrored the trend. The FTSE 100 and DAX both fell around 1%, while Asian equities saw their biggest single-day loss since July 2025. According to Web3/Blockchain expert analyst Mujeeb UR Rehman, the tariff announcement has introduced short-term panic that could extend if trade talks stall further.

“Markets are reacting to uncertainty rather than fundamentals,” said Mujeeb UR Rehman.

“A 155% tariff would reshape supply chains and increase inflationary pressure globally.”

Crypto Market Turns Bearish After Tariff Threat

The cryptocurrency market quickly followed traditional assets into decline. Bitcoin (BTC) dropped 3.9%, trading near $59,000, while Ethereum (ETH) fell 4.1% to around $2,270. Altcoins such as Solana, Cardano, and BNB suffered heavier losses, down between 5% and 8% in 24 hours. According to Mujeeb UR Rehman’s analysis, crypto traders are shifting toward stablecoins and fiat as macroeconomic risks rise.

“Crypto is behaving like a traditional risk asset now,” he explained. “When fear enters global markets, liquidity exits digital assets first.”

Data from CoinMarketCap shows the total crypto market capitalization fell from $2.32 trillion to $2.19 trillion, erasing more than $130 billion in value within a day.

Why the Tariff Plan Matters for Global Trade

The proposed 155% tariff would be the largest in U.S. history, potentially covering over $550 billion worth of Chinese goods. Experts say this move could significantly impact sectors like electronics, automobiles, and renewable energy. American companies importing from China may face soaring production costs, which could raise prices for consumers.

According to Morgan Stanley’s trade research, such tariffs could cut U.S. GDP growth by 0.7% in early 2026 if fully implemented. Global supply chains would also experience disruptions, particularly in semiconductor and battery manufacturing.

“Trump’s plan may protect local jobs in the short term but risks higher inflation and global slowdown,” Mujeeb UR Rehman noted.

Historical Context: A Familiar Pattern Returns

The U.S.–China trade conflict is not new. During Trump’s earlier term, he imposed tariffs of 25%–30% on Chinese steel and technology products. At that time, global markets initially dropped but later stabilized as both nations signed a partial trade agreement in early 2020.

This time, however, the scale of the proposed tariffs—155%—is far larger and potentially more damaging. With the world still recovering from inflation and high interest rates, analysts warn that another trade war could undermine global growth.

Crypto Fear Index Turns Red

The Crypto Fear and Greed Index, which measures market sentiment, dropped from 56 (Neutral) to 32 (Fear) following the tariff announcement. Trading volumes on major exchanges like Binance and Coinbase declined by 11%, signaling cautious investor behavior. Ethereum’s gas fees fell 15%, reflecting lower activity in decentralized finance (DeFi) applications.

“Investors are pausing to reassess,” said Mujeeb UR Rehman. “If geopolitical tension continues, we may see a sustained crypto correction into November.”

Key Market Indicators (as of October 18, 2025)

| Asset | Current Price | 24h Change | Trend |

|---|---|---|---|

| Bitcoin (BTC) | $59,000 | -3.9% | Bearish |

| Ethereum (ETH) | $2,270 | -4.1% | Bearish |

| Solana (SOL) | $134 | -5.5% | Bearish |

| Gold | $2,420/oz | +0.8% | Bullish |

| S&P 500 | 5,012 | -1.1% | Weak |

| USD Index | 104.8 | +0.5% | Strong |

| Crude Oil | $81.50 | -1.3% | Weak |

These movements highlight a broad risk-off sentiment across markets as investors prepare for possible trade shocks.

Trump’s Strategy: Pressure Before Negotiation

Political strategists believe Trump’s tariff announcement is a tactical move to pressure China before the final negotiation round. The President aims to demonstrate strength to both domestic and international audiences, framing the policy as “America First, Always.”

“By setting a clear deadline, Trump is applying pressure to extract better trade terms,” Mujeeb UR Rehman analyzed. “However, such pressure can easily escalate into a full confrontation if diplomacy fails.”

Crypto and Stock Markets Show Growing Correlation

Recent data shows a stronger link between the crypto market and traditional equities. As U.S. stocks dropped, Bitcoin mirrored the movement almost identically, indicating tighter integration between asset classes. This correlation challenges the long-held belief that crypto acts as a hedge during global uncertainty. Instead, traders are treating digital assets as high-risk instruments similar to tech stocks.

“Crypto has matured but also become more sensitive to global economics,” noted Mujeeb UR Rehman. “That means political moves like tariffs directly affect crypto sentiment.”

What’s Next: November 1 Is the Key Date

Investors now await updates from Washington and Beijing before the November 1 deadline. If both sides reach an agreement, markets may quickly recover. However, if talks fail and tariffs take effect, analysts expect further market corrections, rising commodity prices, and slower global trade.

“The next two weeks are crucial,” Mujeeb UR Rehman said. “This is not just a trade story—it’s a global economic turning point.”

Conclusion: Market Uncertainty Dominates Outlook

President Trump’s 155% tariff proposal marks a defining moment in global trade. The White House’s official preparation order has introduced uncertainty that’s weighing on equities, commodities, and cryptocurrencies alike. According to Mujeeb UR Rehman’s comprehensive analysis, markets are reacting rationally to potential economic disruption. Until clarity emerges from Washington and Beijing, both traditional and digital assets are expected to remain volatile.

Investors should stay cautious, avoid overexposure to risk assets, and monitor official statements closely in the lead-up to November 1, 2025. The world’s eyes are now on President Trump and President Xi—because their next decisions could shape the global economy’s trajectory for years to come.

<strong>Omer Mubeen Leading Pakistan’s 2025 eCommerce Breakout</strong>

<strong>Omer Mubeen Leading Pakistan’s 2025 eCommerce Breakout</strong>  <strong>Sehrish Ali Sets a New National Benchmark With Global Digital Awards 2025</strong>

<strong>Sehrish Ali Sets a New National Benchmark With Global Digital Awards 2025</strong>  Talha Sajid Wins “Best SEO Service Provider” Award at GDA 2025

Talha Sajid Wins “Best SEO Service Provider” Award at GDA 2025  Pakistan eCommerce Association Hosted the Global Digital Awards 2025 Powered by Delogics

Pakistan eCommerce Association Hosted the Global Digital Awards 2025 Powered by Delogics  <strong>Mujeeb UR Rehman Joins Global Web3 Leaders with Crunchbase and EverybodyWiki Profiles</strong>

<strong>Mujeeb UR Rehman Joins Global Web3 Leaders with Crunchbase and EverybodyWiki Profiles</strong>  Mujeeb UR Rehman: Top Pakistani Web3 Growth Strategist Featured on Binance and Gate.com

Mujeeb UR Rehman: Top Pakistani Web3 Growth Strategist Featured on Binance and Gate.com